Navigating Banking in Japan: A Guide for Foreigners

Navigating Banking in Japan: A Guide for Foreigners

Navigating the Japanese banking system as a foreigner can be challenging, especially due to language and cultural barriers. This guide aims to provide you with essential information and resources to help you open an account and manage your finances smoothly.

The Big Three:

While there's no official definition, Sumitomo Mitsui Banking Corporation, Mitsubishi UFJ Bank, and Mizuho Bank are considered the "megabanks" of Japan. These institutions boast extensive branch networks and ATMs across the country.

Opening an Account:

Opening a bank account in Japan has become increasingly difficult for newcomers, often requiring 6 months of residency. The Japan Post Bank offers a more accessible option for foreign residents and international students. Additionally, having a mobile phone number is essential for most banking services.

Preparing for Your Visit:

When visiting the bank, ensure you have your residence card, seal, and complete the required paperwork. Even minor mistakes require re-writing documents, often in kanji. Consider bringing someone who speaks Japanese to assist you.

Banking Hours and Online Services:

Bank counters operate from Monday to Friday, 9:00 AM to 3:00 PM. ATM hours vary, with some open until midnight or 24/7. Online banking is becoming increasingly popular, offering convenient access to your finances.

Beyond the Big Three:

While the megabanks offer comprehensive services, several other banks cater to specific needs, including:

- Resona Bank: Known for its strong business banking services.

- Rakuten Bank: Offers online banking with competitive interest rates and a user-friendly app.

- Sony Bank: A leading online bank with innovative features and a focus on environmental sustainability.

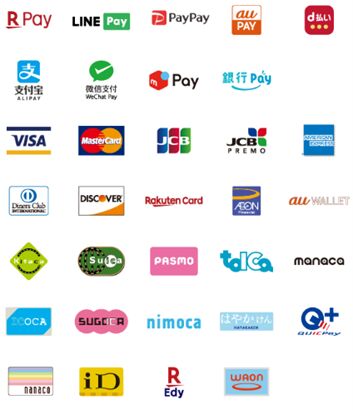

Cashless Payments and Point Cards:

Cashless payments have significantly increased in Japan, with electronic money becoming mainstream. Popular options include Suica, PASMO, PayPay, and iD. Look for signs at stores indicating accepted payment methods.

Point cards are also widely used in Japan, offering rewards and discounts for loyal customers. Popular programs include T point, d point, Rakuten Points, and Ponta.